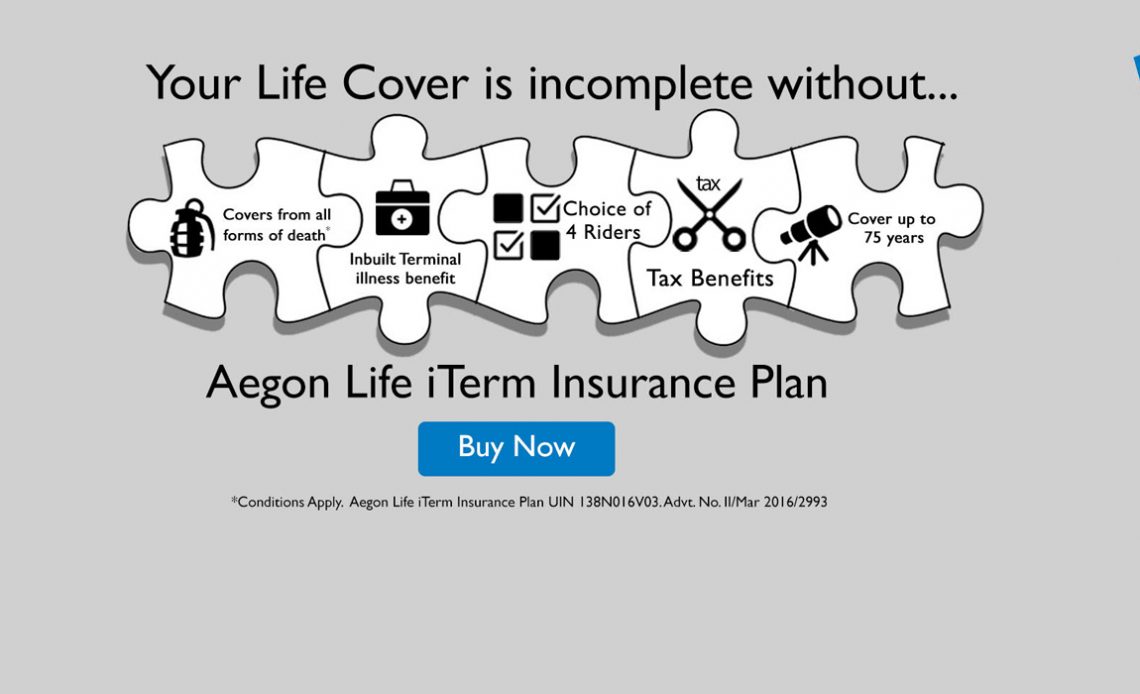

Aegon Life AD Rider: In case of an accidental death of the life assured, the sum assured under the rider will be paid.

Aegon Life iCI Rider: It covers 4 critical illness conditions i.e cancer, open chest CABG, first heart attack and stroke.

Aegon Life WOP Rider: For the above mentioned 4 critical illness, future premiums payabale under the base plan and riders (if any) are waived

Aegon Life Women CI Rider: for illness pertaining to women covered into two groups – malignant cancer of the female organs and birth of child with congenital disorders and complications.

Aegon life disability rider: offering an immediate lump sum payout along with waiver of future outstanding premiums of the base plan in case of permanent disability of the life.

“Our main focus for every consumer is protection. Every family is important for every individual. iTerm which comes will every technological and innovative benefits, will be an ideal choice for every household” said Martijn de Jong, Chief Digital Officer, Aegon life insurance.

]]>