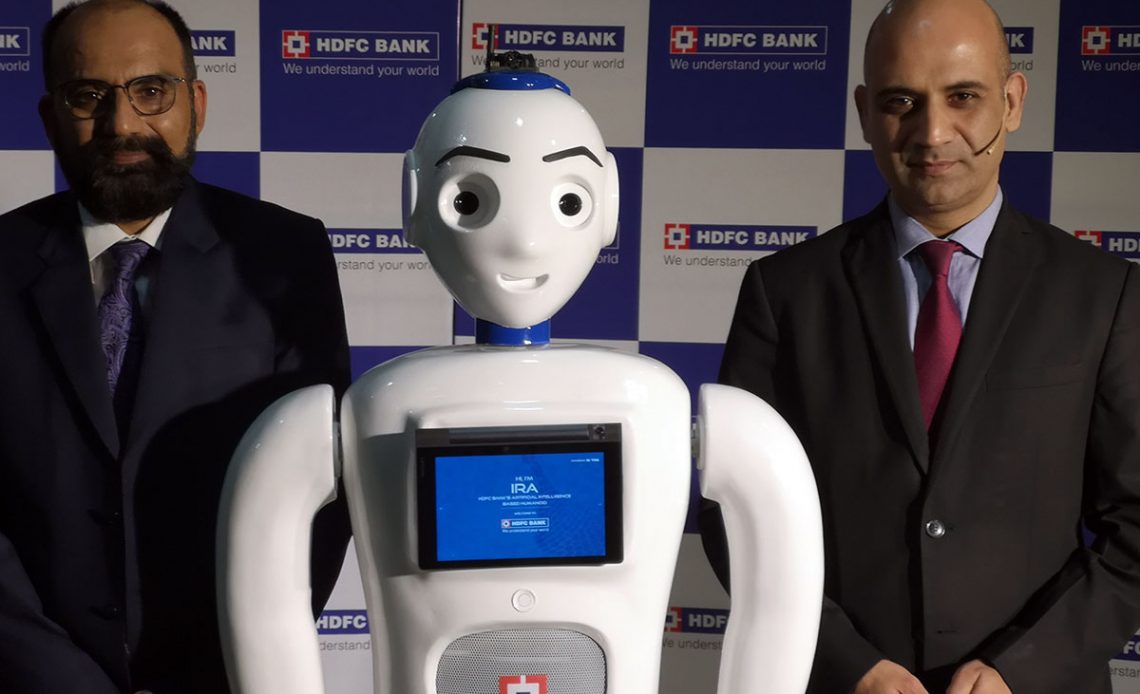

IRA 2.0 Humanoid Robot IRA is the first of its kind implementation in the banking industry in India, introducing a humanoid for customer service. The technology has been developed by HDFC Bank in collaboration with its technology partners Invento Makerspaces and Senseforth Technologies. The first version of the IRA was launched in January 2017 at the Bank’s Kamala mills branch in Mumbai and is now currently stationed at the Palarivattom branch in Kochi. HDFC bank is actively pursuing to better the Humanoid experience and the IRA 2.0 is the next progression level with few more advance skills added to it. By mapping the branch layout, customers can not only ask certain banking queries to the humanoid but IRA 2.0 can also walk them to the designated counters. The future road map for IRA includes communicating in-depth the banking products, suggestions, give information about bank accounts, handle service requests and provide the status of applications or requests.

HDFC EVA – Virtual Assistant

Amazon’s virtual assistant, Alexa enabled devices are slowly finding into the homes of Indian households and Google Assistant is practically in almost all the Android phones in our hands. Taking leverage of these two powerful assistants, HDFC has integrated their virtual assistant EVA to work with both. HDFC is the first bank to offer voice banking experience on Alexa. Since its launch, EVA which stands for

To offer the simplicity and convenience of a voice conversation to banking transactions, HDFC Bank’s virtual assistant ‘EVA’ has been successfully integrated with Amazon Alexa, making it the first bank to offer voice banking experience on Alexa. Since its launch, EVA, which stands for ‘Electronic Virtual Assistant’ has addressed over 65 lakh queries on voice and chat-based channels with over 85 per cent accuracy. With this integration, HDFC Bank customers can now chat with EVA using voice from the comfort of their homes, without having to pick up a phone, tablet or laptop.

Amazon’s virtual assistant, Alexa enabled devices are slowly finding into the homes of Indian households and Google Assistant is practically in almost all the Android phones in our hands. Taking leverage of these two powerful assistants, HDFC has integrated their virtual assistant EVA to work with both. HDFC is the first bank to offer voice banking experience on Alexa. Since its launch, EVA which stands for

To offer the simplicity and convenience of a voice conversation to banking transactions, HDFC Bank’s virtual assistant ‘EVA’ has been successfully integrated with Amazon Alexa, making it the first bank to offer voice banking experience on Alexa. Since its launch, EVA, which stands for ‘Electronic Virtual Assistant’ has addressed over 65 lakh queries on voice and chat-based channels with over 85 per cent accuracy. With this integration, HDFC Bank customers can now chat with EVA using voice from the comfort of their homes, without having to pick up a phone, tablet or laptop.

EVA Skill on Alexa

So what can customers can ask EVA on Alexa? In the first phase which has been implemented now, an user after integrating the EVA skill on Alexa can ask about

So what can customers can ask EVA on Alexa? In the first phase which has been implemented now, an user after integrating the EVA skill on Alexa can ask about

- bank’s product features,

- fees and charges,

- interest rates,

- credit card reward points / payment date / expiry date

- branches (address, IFSC).

- Customers can also enquire about how to block/unblock card, what to do if one forgets pin, and update personal information.

EVA on Google Assistant

While Alexa is still not at every home, Google Assistant is in almost every Android phone and Android phones have the lion’s share in the mobile segment. By integrating EVA to the Google Assistant, HDFC bank has taken the voice-based banking to the masses. With the launch of the Google home in India, EVA can be accessed on those devices too.

Instead of typing, users can simply say “Ok Google, talk to HDFC Bank” to their Google Assistant to interact with Eva. By voice users can make queries on banking products and features like in Alexa skill.

IRA 2.0 and EVA are definitely a milestone in the digital banking momentum taking place in the banking industry in India and HDFC bank is taking the lead in the space. Voice based technology interaction is where the future is heading to and HDFC has made a jump start and now provides a simple and intuitive voice interactions through their Smartphones, Alexa Echo and Google home products so that users can conveniently access information anywhere, anytime.

Who said banking is a boring affair? Not anymore.

]]>

While Alexa is still not at every home, Google Assistant is in almost every Android phone and Android phones have the lion’s share in the mobile segment. By integrating EVA to the Google Assistant, HDFC bank has taken the voice-based banking to the masses. With the launch of the Google home in India, EVA can be accessed on those devices too.

Instead of typing, users can simply say “Ok Google, talk to HDFC Bank” to their Google Assistant to interact with Eva. By voice users can make queries on banking products and features like in Alexa skill.

IRA 2.0 and EVA are definitely a milestone in the digital banking momentum taking place in the banking industry in India and HDFC bank is taking the lead in the space. Voice based technology interaction is where the future is heading to and HDFC has made a jump start and now provides a simple and intuitive voice interactions through their Smartphones, Alexa Echo and Google home products so that users can conveniently access information anywhere, anytime.

Who said banking is a boring affair? Not anymore.

]]>